Centralized CKYC, Customer and Liability

CKYC software for Money lenders

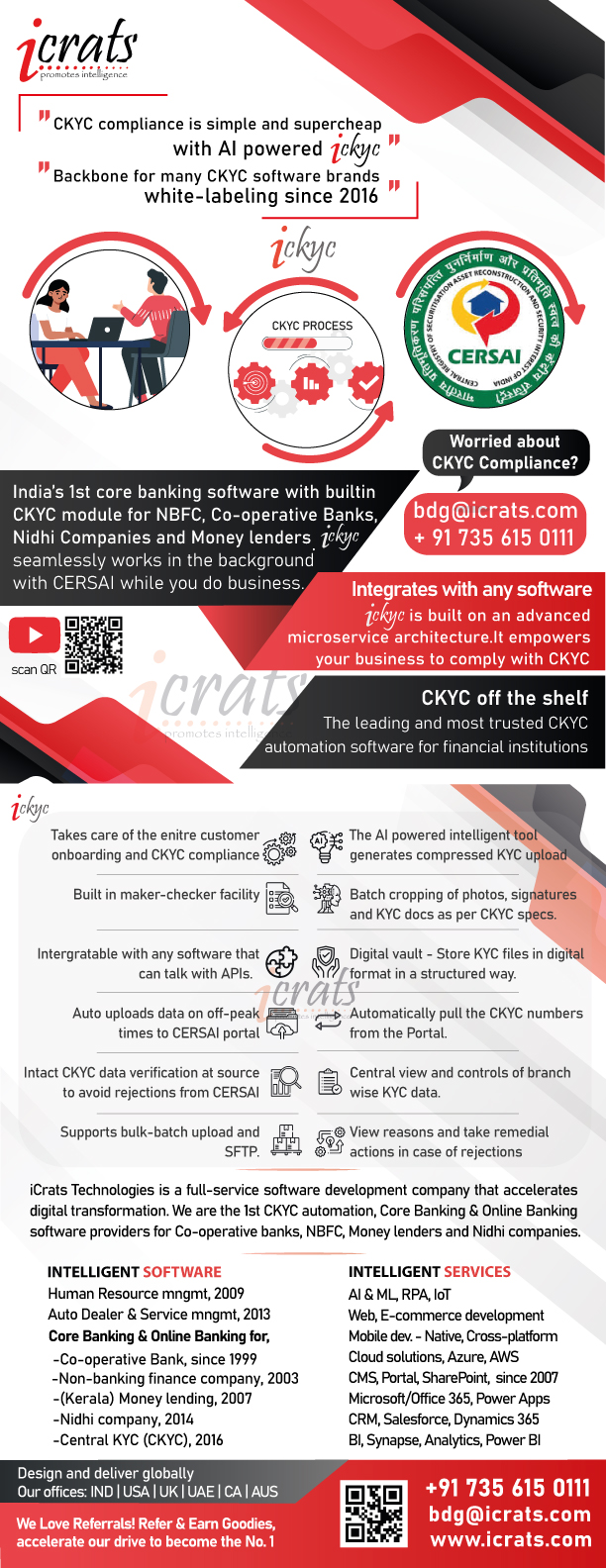

Central KYC Registry is a centralized repository of KYC records of customers in the financial sector with uniform KYC norms and inter-usability of the KYC records across the sector with an objective to reduce the burden of producing KYC documents and getting those verified every time when the customer creates a new relationship with Public Sector Banks, Private Banks, Foreign Banks, Co-Operative Banks, Regional Rural Banks, Local Area Banks, Financial Institutions, Housing Finance Companies, Microfinance, Digital Payment Companies and moreWe at icrats build a standalone module in 2018 to ease financial institutions to upload KYC records through screen-based single entry and batch upload. Our integrated CKYC module enables our clients in urban co-operative banks, NBFCs, and Nidhi Companies to set auto-upload on off-peak times using the API provided by CKYC. It's integrated with iBanking Money lenders, icrats core banking software for Money lenders or KML, and with many other Money lender software in the market.

Our intelligent CKYC software can be integrated with any software using our API. The built-in validations will make sure that all naming conventions, field-values, documents, image sizes are intact. Click here to download your iCKYC Brochure

Customer management module for NBFC

- User definable Customer Class Type and its attributes.

- Customer Application processing.

- Automated Customer Number generation.

- All customer related transactions can be carried out from a single user interface (screen).

- Official/ Residential / Mailing addresses of a customer can be updated and the address history is maintained.

- Customer’s Photo, Signature, KYC, CKYC can be stored within the database (system).

- Customer status displayed as alerts.

- Customer search (with Bit search) for the given address criteria.

- Customer Registers (Admitted, Disqualified, Expired).

Liability Scrutiny

- Liability as on a date for specified customer number.

- Provision to choose between Direct and Indirect Liability or both can be calculated simultaneously.

- Flexibility in modules to be considered for liability calculation.

- Provision for taking printouts of member liability.

- Available from all ledger screens.