CKYC software and NBFC systems

- iBanking - NBFC

- Collection Agent Mobile App

- CKYC, Liability management sys

- Gold Loan management system

- Term Loan management system

- Microfinance management system

- Payday Loan management system

- Debenture Loan management sys

- NCD, Bond, Sub. debt management sys

- Fixed Deposit management system

- Overdraft / CC management system

- Chitty / GD / MBF management system

- Locker management system

- Maker-checker module

- Business analytics module

- Administration module

- iBanking - Evolution

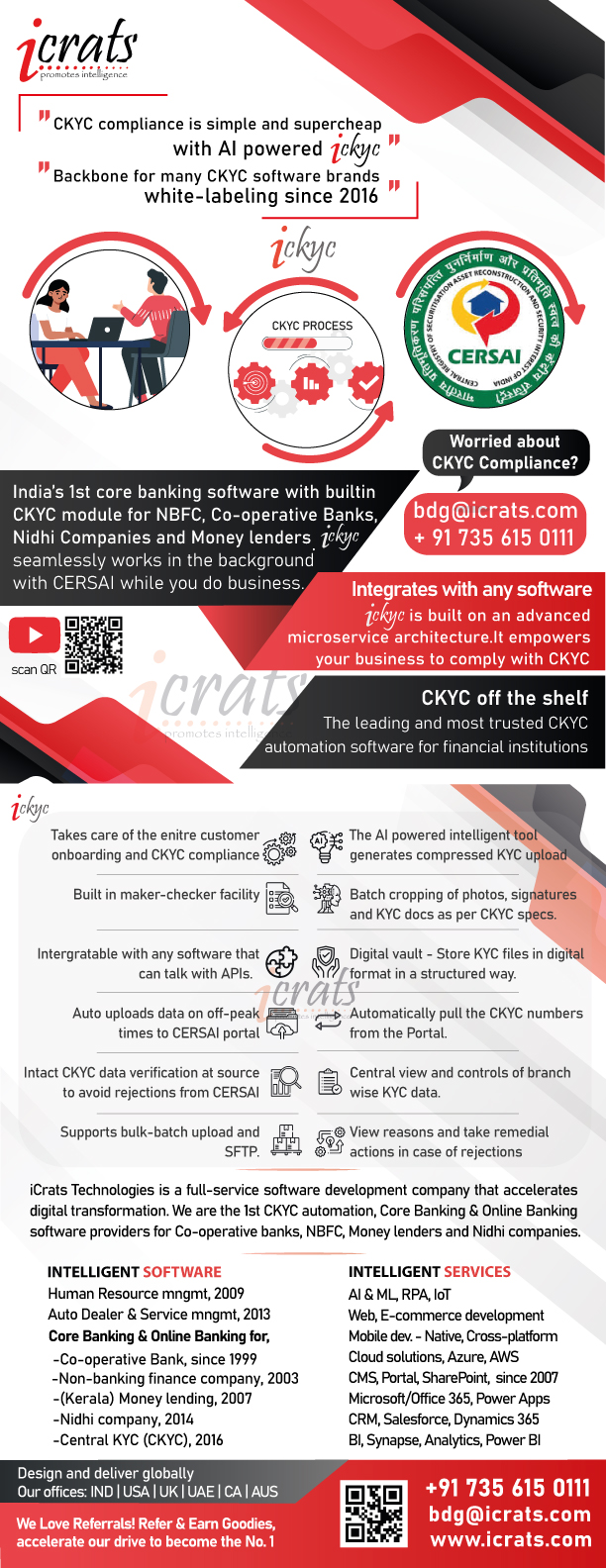

CKYC software for NBFC

Central KYC Registry is a centralized repository of KYC records of customers in the financial sector with uniform KYC norms and inter-usability of the KYC records across the sector with an objective to reduce the burden of producing KYC documents and getting those verified every time when the customer creates a new relationship with Public Sector Banks, Private Banks, Foreign Banks, Co-Operative Banks, Regional Rural Banks, Local Area Banks, Financial Institutions, Housing Finance Companies, Microfinance, Digital Payment Companies and moreWe at icrats build a standalone module in 2018 to ease financial institutions to upload KYC records through screen-based single entry and batch upload. Our integrated CKYC module enables our clients in urban co-operative banks, NBFCs, and Nidhi Companies to set auto-upload on off-peak times using the API provided by CKYC. It's integrated with icrats iBanking NBFC, a core banking software for NBFC, and with many other NBFC software in the market.

Our intelligent CKYC software can be integrated with any software using our API. The built-in validations will make sure that all naming conventions, field-values, documents, image sizes are intact. Click here to download your iCKYC Brochure

Customer management module for NBFC Software

- User definable Customer Class Type and its attributes.

- Customer Application processing.

- Automated Customer Number generation.

- All customer related transactions can be carried out from a single user interface (screen).

- Official/ Residential / Mailing addresses of a customer can be updated and the address history is maintained.

- Customer’s Photo, Signature, KYC, CKYC can be stored within the database (system)

- Customer status displayed as alerts

- Customer search (with Bit search) for the given address criteria

- Customer Registers (Admitted, Disqualified, Expired)

Liability Scrutiny software for NBFC Software

- Liability as on a date for specified customer number.

- Provision to choose between Direct and Indirect Liability or both can be calculated simultaneously.

- Flexibility in modules to be considered for liability calculation.

- Provision for taking printouts of member liability.

- Available from all ledger screens.